The pair have flagged an all-scrip merger to create a district-scale, gold-silver explorer in the patchwork Stewart mining camp.

"The Stewart camp has been in desperate need of consolidation on this scale for decades," AUX CEO Ian Slater said.

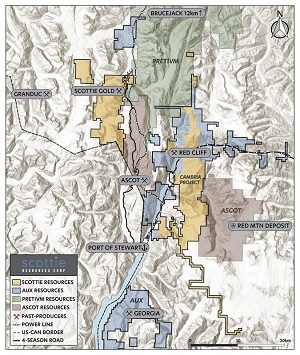

The transaction would result in a 522sq.km package containing historical mines and three advanced projects - Scottie's namesake project and former gold mine, the company's Cambria project and AUX's high-grade brownfields Georgia project.

Under the letter of intent, Scottie would acquire AUX on a share-for-share basis, with AUX expected to then hold about 31% of Scottie.

Scottie was expected to be well-capitalised with more than C$6 million in cash.

Drilling was planned for the three advanced projects in the 2021 field season.

Scottie's significant infrastructure in Stewart would provide operational synergies with AUX's projects, the Sprott-backed pair said.

Scottie Resources and AUX Resources projects in BC

High-profile investor Eric Sprott had become a significant shareholder of Scottie in January 2020, investing $2 million at 20c per unit for an 11.5% stake.

His investment vehicle 2176423 Ontario Ltd invested $2 million at 22.5c per unit in AUX in February, giving him a 16.4% interest on a non-diluted basis.

Scottie shares (TSXV: SCOT), which have spanned 18-53c over the past year, closed up 5.1% to 20.5c, capitalising it at $24.7 million (US$19.6 million).

AUX shares (TSXV: AUX) have similarly spanned 17-56c over 12 months but lost 4.3% yesterday to close at 22c, valuing it at $9.4 million (US$7.5 million).